Does Insurance Cover IVF? Your Guide to Understanding Coverage, Costs, and Options

In vitro fertilization (IVF) is a life-changing option for many people dreaming of starting a family. But with a single cycle costing anywhere from $12,000 to $30,000, one big question looms large: Does insurance cover IVF? If you’re asking this, you’re not alone. Millions of Americans face infertility, and the financial side of treatment can feel overwhelming. The good news? Coverage is evolving, and there are ways to make IVF more affordable. The not-so-good news? It’s complicated, and the answer depends on where you live, your insurance plan, and even your employer.

This article dives deep into everything you need to know about insurance and IVF. We’ll break down how coverage works, what’s changing in 2025, and practical steps to figure out your options. Plus, we’ll explore fresh angles—like how employers are stepping up and what new research says about access—that you won’t find in most other guides. Whether you’re just starting to explore IVF or you’re knee-deep in the process, stick around. This is your roadmap to clarity.

What Is IVF, and Why Does Insurance Matter?

IVF is a medical procedure where eggs are retrieved from the ovaries, fertilized with sperm in a lab, and then transferred into the uterus. It’s often a go-to for people facing infertility due to blocked fallopian tubes, low sperm count, or other challenges. It’s also a key option for same-sex couples, single parents, or those preserving fertility before cancer treatment. One round can take weeks and involves medications, monitoring, and skilled doctors—hence the hefty price tag.

Insurance matters because, without it, IVF can drain savings or push families into debt. A 2023 study from the American Society for Reproductive Medicine found that fewer than 25% of infertile couples have adequate access to care, largely due to cost. Coverage can be the difference between pursuing your dream of parenthood and putting it on hold indefinitely.

The Big Picture: Does Insurance Typically Cover IVF?

Here’s the short answer: It depends. In the U.S., there’s no federal law requiring insurance to cover IVF or other fertility treatments. That means coverage varies wildly based on your state, your insurance provider, and whether your plan is through an employer or bought individually. Let’s break it down.

Private Insurance Plans

Most private insurance plans don’t automatically cover IVF. Some cover diagnostic tests—like bloodwork or ultrasounds—to figure out why you’re struggling to conceive. But when it comes to treatment? That’s where things get tricky. Only about 1 in 4 employer-sponsored plans include IVF coverage, according to a 2021 Mercer survey. If your plan does cover it, you might still face limits, like a cap on cycles (say, three) or high out-of-pocket costs.

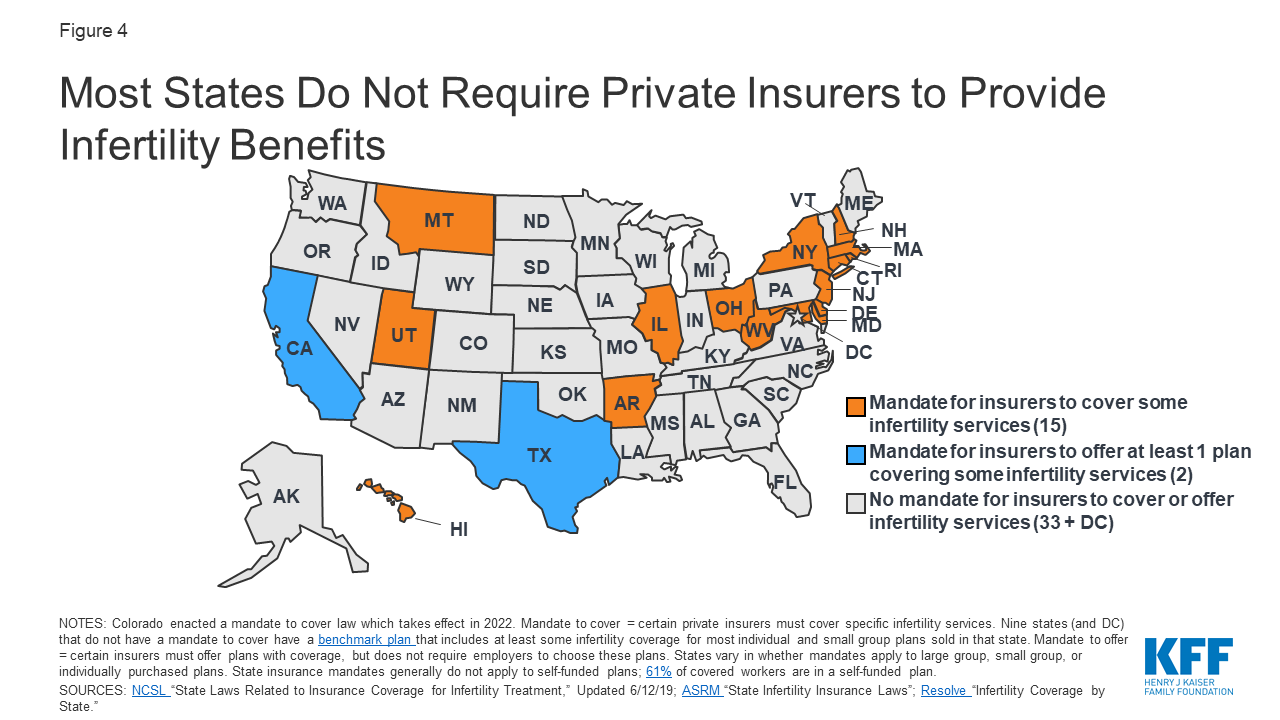

State Mandates: Where You Live Changes Everything

As of April 2025, 21 states and Washington, D.C., have laws requiring some level of infertility coverage. But here’s the catch: not all include IVF. Only 15 states mandate IVF coverage specifically, and even then, there are loopholes. For example:

- Massachusetts and Illinois have strong mandates, covering multiple IVF cycles with few restrictions.

- California requires infertility coverage but excludes IVF unless your employer opts in.

- Texas mandates IVF coverage, but only if you use your spouse’s sperm—leaving out many couples.

If you live in one of the 29 states without mandates (like Florida or Pennsylvania), you’re usually out of luck unless your employer chooses to offer it. Check your state’s status—it’s a game-changer.

Medicaid and Medicare

Public insurance like Medicaid rarely covers IVF. Only one state, New York, includes limited fertility treatment under Medicaid, but it’s mostly diagnostics, not IVF itself. Medicare doesn’t cover it either, since it’s designed for people over 65, not typically those building families. If you rely on these programs, you’ll likely need to explore other funding options.

What’s Covered When Insurance Does Kick In?

Even with coverage, IVF isn’t a free ride. Plans that include it often have specific rules. Here’s what you might see:

✔️ Covered: Egg retrieval, lab fertilization, embryo transfer, and sometimes medications (like hormone shots costing $3,000-$6,000 per cycle).

❌ Not Covered: Extra services like genetic testing ($2,000-$5,000), embryo storage ($500-$1,000 yearly), or donor eggs/sperm (up to $15,000).

Some plans require you to try cheaper options first, like intrauterine insemination (IUI), before approving IVF. Others cap coverage at a dollar amount (e.g., $15,000 lifetime) or a set number of cycles. And don’t forget deductibles or co-pays—those can add thousands to your bill.

Real-Life Example: Sarah’s Story

Sarah, a 32-year-old teacher in New Jersey, had insurance through her job. Her state mandates IVF coverage, so her plan covered three cycles. But she still paid $4,000 out of pocket per round for meds and lab fees not fully covered. After two cycles, she welcomed twins—and a $10,000 total bill. Coverage helped, but it wasn’t a golden ticket.

Why Isn’t IVF Covered More Often?

Insurance companies often see IVF as “elective,” not “medically necessary,” even though the World Health Organization calls infertility a disease. Critics argue this view ignores the emotional and physical toll of infertility—40% of infertile women face anxiety or depression, double the rate of fertile women, per a 2018 study. So why the resistance?

- Cost Concerns: One IVF cycle costs insurers $12,000-$20,000. Multiply that by millions of patients, and it’s a big hit to their bottom line.

- Political Pushback: Proposals like the “Right to IVF Act” (blocked in Congress in 2024) face opposition from fiscal conservatives and groups who see embryos as people, complicating mandates.

- Employer Choice: Many companies self-insure, meaning they’re exempt from state laws and can skip IVF coverage to save money.

But the tide’s turning. More employers are adding IVF benefits to attract talent, and public support is growing—55% of Americans back private insurance covering IVF, per a 2023 survey.

New Trends in 2025: What’s Changing?

IVF coverage isn’t static. Here’s what’s shifting as of April 2025, based on recent developments and chatter trending on platforms like X.

Employers Are Stepping Up

Big names like Google, Amazon, and Starbucks now offer IVF benefits, covering up to $25,000 or more. Smaller companies are following suit, especially in tight job markets. A 2024 report from Maven Clinic found that 1 in 5 employees leave jobs due to lack of fertility support—pushing employers to act. If your company doesn’t offer it, ask HR. It might spark a change.

States Are Expanding Access

Delaware joined the IVF mandate club in 2024, bringing the total to 15 states. Advocates in states like Michigan and Virginia are pushing similar laws, fueled by stories of families priced out of parenthood. Keep an eye on your local legislature—2025 could bring surprises.

Political Promises

During the 2024 election, some candidates pledged to mandate IVF coverage nationwide. While nothing’s law yet, it’s a hot topic. If it passes, it could cost taxpayers $7 billion yearly, per the Cato Institute—but it’d open doors for millions.

How to Check If Your Insurance Covers IVF

Wondering about your plan? Don’t guess—dig in. Here’s a step-by-step guide:

- Read Your Policy: Look for terms like “infertility,” “IVF,” or “assisted reproductive technology” in your benefits booklet. It’s usually online via your insurance portal.

- Call Member Services: Dial the number on your insurance card. Ask: “Does my plan cover IVF? What about meds or storage?” Write down names and dates—you might need proof later.

- Talk to HR: If you’re on an employer plan, ask if they’ve added fertility benefits. Some companies offer them quietly.

- Check State Laws: Google “[Your State] infertility insurance mandate” to see if you’re protected by law.

- Get Pre-Authorization: If IVF’s covered, your doctor may need to submit proof of infertility (e.g., 12 months of trying) before approval.

Quick Tip: Record calls or get emails confirming coverage. Insurance can backtrack if it’s not in writing.

Interactive Quiz: Is IVF Covered for You?

Take a minute to test your situation. Answer these, then tally your “Yes” answers:

- Do you live in one of the 15 states with IVF mandates? (e.g., NY, NJ, MA)

- Does your employer offer fertility benefits? (Check with HR!)

- Is your insurance a large-group plan (over 100 employees)?

- Have you been diagnosed with infertility by a doctor?

- Are you under 45? (Some plans have age cutoffs.)

Results:

- 4-5 Yeses: Good chance you’re covered—confirm with your insurer!

- 2-3 Yeses: Maybe, but expect limits or costs. Dig deeper.

- 0-1 Yes: Likely not covered—explore alternatives below.

What If Insurance Doesn’t Cover IVF?

No coverage? Don’t lose hope. There are smart ways to make IVF work financially.

Financing Options

- Fertility Loans: Companies like Future Family offer loans with low interest, tailored for IVF. Payments can stretch over years.

- Clinic Discounts: Some centers offer multi-cycle packages (e.g., $20,000 for three tries) or refunds if you don’t conceive.

- Grants: Groups like Baby Quest Foundation give $5,000-$15,000 to qualifying applicants. Apply early—funds run out fast.

Out-of-Pocket Hacks

- Shop Around: IVF costs vary by clinic. A center an hour away might save you thousands.

- Tax Breaks: The IRS lets you deduct medical expenses over 7.5% of your income—IVF qualifies. Talk to a tax pro.

- Health Savings Accounts (HSAs): If you have one, use pre-tax dollars for IVF. It’s like a 20-30% discount.

Case Study: Mark and Lisa’s Plan

Mark and Lisa, a couple in Ohio (no mandate), faced a $25,000 IVF bill. Their insurance covered nothing. They found a clinic offering a two-cycle deal for $18,000, used an HSA for $5,000, and took a $10,000 loan at 4% interest. After one cycle, they had a daughter—and a manageable $200 monthly payment.

The Hidden Costs of IVF Coverage Gaps

Lack of insurance doesn’t just hit your wallet—it affects your health and choices. Research from 2022 in Reproductive Biomedicine Online found that in states without mandates, doctors skip key surgeries (like fixing blocked tubes) due to cost, lowering IVF success rates. This gap hits low-income and minority groups hardest—Black women, for instance, are twice as likely to face infertility but less likely to access care, per the CDC.

Emotionally, it’s brutal. Couples delay treatment, piling on stress. One X user in 2025 summed it up: “IVF’s a privilege for the rich unless you’re lucky enough to live in the right state.”

Fresh Insights: 3 Things Other Guides Miss

Most articles stop at “check your plan” or “move to Massachusetts.” Here’s what they’re not telling you—and why it matters.

1. Fertility Preservation Is a Game-Changer

If you’re facing cancer or gender-affirming surgery, IVF can freeze your eggs or embryos for later. Seventeen states now mandate coverage for this “iatrogenic infertility,” but it’s under-discussed. A 2024 study in Fertility and Sterility found 30% of young cancer patients skip preservation due to cost—insurance could save their future family plans. Ask your doctor if this applies to you.

2. Employers Might Pay More Than You Think

Beyond big tech, even mid-sized firms are quietly adding IVF perks. A 2025 Maven Clinic poll showed 60% of HR leaders plan to expand fertility benefits by 2027, driven by employee demand. If your company’s on the fence, share stats: Firms with IVF coverage see 10% higher retention rates. You could tip the scales.

3. Success Rates Vary by Coverage

Here’s a twist: Insurance might boost your odds. A 2023 JAMA study found that in states with mandates, patients transfer fewer embryos per cycle (reducing risky multiples) and have a 5% higher live birth rate. Why? Covered patients can afford top clinics and extra cycles. No coverage? You might rush or settle, hurting your chances.

Your Action Plan: Making IVF Work in 2025

Ready to take charge? Here’s how to navigate the maze, whether you’re covered or not.

If You Have Coverage

- Maximize It: Use every cycle or dollar allowed. Ask about “add-ons” (like embryo testing) and if they’re included.

- Plan Ahead: Schedule treatments before policy changes—some employers tweak benefits yearly.

- Appeal Denials: If insurance says no, fight back with medical records and state law details. One in three appeals wins, per Resolve.

If You Don’t Have Coverage

- Negotiate: Clinics often cut deals for cash payers—ask for a discount or payment plan.

- Crowdfund: Friends and family might chip in via GoFundMe. One couple raised $8,000 in 2024 this way.

- Move Strategically: If you’re near a mandate state, a job switch could unlock coverage. Worth it? Run the numbers.

Poll: What’s Your Biggest IVF Worry?

We want to hear from you! Pick one:

A) Cost, even with insurance

B) Finding a good clinic

C) Emotional stress of the process

D) No coverage at all

Drop your answer in the comments—it’ll help us tailor future advice!

The Future of IVF Coverage: What’s Next?

Looking ahead, IVF access is at a crossroads. Advocates say it’s a human right, not a luxury—backed by 69% of Americans supporting coverage for medical infertility, per a 2023 poll. Employers and states are listening, but federal action lags. If costs drop (new tech like microfluidics could slash prices by 2030, per PMC), insurance might catch up.

For now, your best bet is knowledge. Know your plan, your state, and your options. IVF’s a marathon, not a sprint—pace yourself, and you’ll find a way.