Does Insurance Pay for IVF? Your Guide to Coverage, Costs, and Options

In vitro fertilization (IVF) is a life-changing option for many people dreaming of starting a family. But let’s be real—it’s expensive. A single cycle can cost anywhere from $12,000 to $25,000, and that’s before you add in medications, testing, or extra procedures. For most folks, the big question isn’t just “Can IVF help me?” but “Can I afford it?” That’s where insurance comes in—or doesn’t. If you’re wondering whether insurance pays for IVF, you’re not alone. It’s a hot topic, and the answer isn’t as simple as yes or no. It depends on where you live, what plan you have, and sometimes even your employer.

This article is your go-to guide. We’ll break down how insurance works with IVF, what’s covered (and what’s not), and how to navigate the messy world of fertility treatment costs. Plus, we’ll dig into some fresh angles—like recent policy changes, real-life stories, and tips you won’t find everywhere else. Whether you’re just starting to explore IVF or you’re deep in the process, stick around. You’ll walk away with a clearer picture and some practical next steps.

Why IVF Costs So Much—and Why Insurance Matters

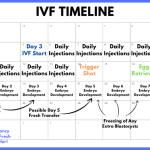

IVF isn’t cheap, and there’s a good reason for that. It’s a multi-step process that involves high-tech equipment, skilled doctors, and a lot of time. First, there’s ovarian stimulation with medications to produce multiple eggs. Then, those eggs are retrieved in a minor surgery. After that, they’re fertilized in a lab, and the resulting embryos are monitored before being transferred back into the uterus. Each step comes with its own price tag—medications alone can run $3,000 to $5,000 per cycle, according to the American Society for Reproductive Medicine (ASRM).

For many, insurance is the lifeline that makes this possible. Without it, you’re looking at paying out of pocket, which can feel like climbing a mountain with no gear. A 2023 study from the Kaiser Family Foundation found that only about 25% of Americans with private insurance have some form of fertility coverage. That leaves a huge chunk of people scrambling to figure out how to fund their dreams of parenthood. So, does insurance step up to the plate for IVF? Let’s dive in.

How Insurance Coverage for IVF Works in the U.S.

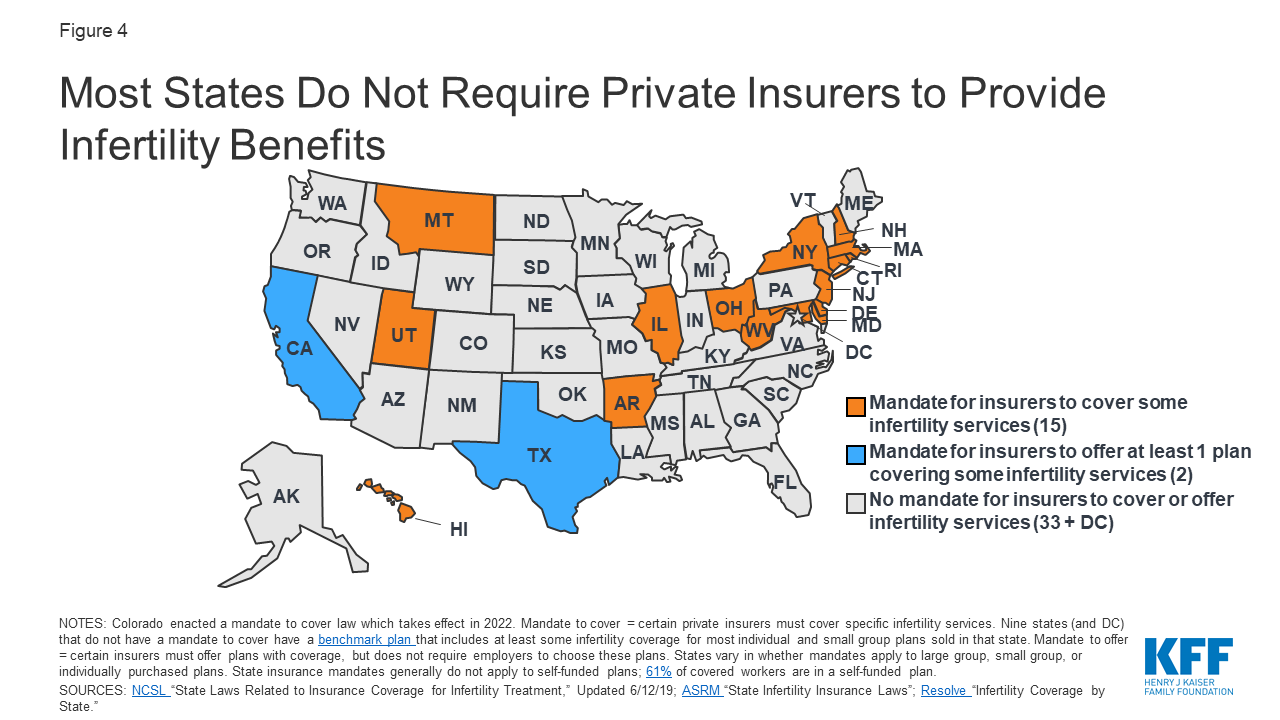

Here’s the deal: insurance coverage for IVF in the United States is a patchwork quilt. It’s not a federal thing—there’s no nationwide rule saying insurers have to cover it. Instead, it’s up to individual states, your insurance plan, and sometimes your employer. This means your neighbor might have full IVF coverage while you’re stuck with nothing, even if you’re both insured.

State Mandates: Where You Live Makes a Difference

As of April 2025, 21 states have laws requiring some level of infertility coverage for private insurance plans. But here’s the catch—not all of them include IVF. According to the National Conference of State Legislatures, only 15 states mandate IVF coverage specifically. These include places like California (as of a new law signed in 2024), New York, and Illinois. Each state has its own rules, though. For example:

- California: Starting July 2025, large group plans must cover up to three egg retrievals and unlimited embryo transfers. But Medi-Cal and religious employers are exempt.

- New York: Large group plans cover three IVF cycles, including egg freezing if it’s part of the process.

- Texas: Insurers have to offer infertility coverage, but employers can opt out, and IVF isn’t always included.

If you live in one of the 29 states without mandates—like Florida or Pennsylvania—you’re at the mercy of your insurance company or employer. No mandate, no guaranteed coverage. It’s a bummer, but it’s the reality for millions.

Private Insurance: A Mixed Bag

Even in states with mandates, private insurance doesn’t always mean full coverage. Many plans cap the number of IVF cycles (usually two or three) or only cover certain parts, like diagnostic tests or medications. A 2024 report from Mercer showed that 36% of large employers (500+ employees) now offer IVF benefits, up from 27% in 2020. That’s progress, but it’s still less than half. Smaller companies? Only about 10% provide fertility benefits.

Self-funded plans—where your employer pays for healthcare directly—are another wrinkle. These cover 61% of workers with employer-sponsored insurance, per KFF, but they’re exempt from state mandates. So, even if your state requires IVF coverage, your self-funded plan might not follow suit.

Public Insurance: Medicaid and Medicare

Don’t count on public programs like Medicaid or Medicare for IVF help. Medicaid coverage varies by state, but most don’t include fertility treatments—Pennsylvania and Florida, for instance, offer zero fertility benefits through Medicaid. Medicare, designed for folks 65 and older, doesn’t cover IVF either, since it’s not typically a need for that age group. There are rare exceptions, like military personnel or veterans through TRICARE or the VA, where limited IVF coverage exists, but it’s not the norm.

What’s Covered (and What’s Not) When Insurance Does Pay

Let’s say you’re one of the lucky ones with IVF coverage. What does that actually mean? It’s not a blank check—there are limits, and they can trip you up if you’re not prepared.

Typical Coverage Breakdown

When insurance covers IVF, it usually includes:

- Ovarian stimulation medications: The drugs that help your body produce eggs.

- Egg retrieval: The procedure to collect those eggs.

- Fertilization and embryo transfer: The lab work and implantation process.

But here’s where it gets tricky:

- Pre-IVF testing: Things like semen analysis or ultrasounds might be covered separately under “infertility diagnosis,” not IVF.

- Freezing eggs or embryos: Some plans cover this, others don’t—New York’s mandate includes it, but California’s doesn’t specify.

- Genetic testing: Preimplantation genetic testing (PGT) to screen embryos? Often an extra cost, averaging $3,000-$6,000.

The Fine Print: Limits and Exclusions

Even with coverage, there’s a catch. Most plans have:

- Cycle limits: Three is common, but some cap it at one or two.

- Age restrictions: Coverage might stop at 40 or 45.

- Out-of-network costs: If your clinic or lab isn’t in-network, you could face big bills. One couple in Florida paid $500 extra for an out-of-network lab, despite having insurance, according to NPR.

And don’t forget deductibles, copays, or coinsurance. A 2022 NPR story highlighted a couple whose “covered” IVF still cost $2,700 out of pocket because of their plan’s maximum.

Real Stories: How Insurance Shapes IVF Journeys

Numbers are one thing, but real life shows the stakes. Take Sarah, a 34-year-old teacher from Illinois. Her state mandates IVF coverage, and her employer’s plan covered two cycles. After one failed attempt, her second cycle worked—she’s now mom to a healthy boy. Total out-of-pocket cost? About $4,000, mostly for meds and copays. “Without insurance, we’d have stopped after one try,” she says.

Contrast that with Mike and Jen in Georgia, a no-mandate state. Their insurance covered diagnostics but not IVF. One cycle cost them $18,000, funded by a loan. “We’re still paying it off,” Jen admits. “It’s worth it for our daughter, but it’s a burden we didn’t expect.”

These stories show the gap. Insurance can be a game-changer—or a dealbreaker.

Interactive Quiz: Does Your Insurance Cover IVF?

Not sure where you stand? Take this quick quiz to get a sense of your situation. Answer yes or no:

- Do you live in one of the 15 states with IVF mandates (e.g., CA, NY, IL)?

- Do you have private insurance through a large employer (100+ employees)?

- Is your plan self-funded (check with HR—it’s common with big companies)?

- Has your doctor diagnosed you with infertility?

- Mostly Yes: You’ve got a decent shot at some coverage. Call your insurer to confirm.

- Mixed: It’s a toss-up—state laws or employer benefits might help, but self-funded plans could block you.

- Mostly No: Coverage is unlikely unless your employer offers it voluntarily.

This isn’t a guarantee, but it’s a starting point. Your next move? Dig into your policy details.

New Trends and Changes in IVF Coverage (2025 Update)

The IVF landscape is shifting, and 2025 is bringing some fresh developments worth knowing about.

Federal Push: Could IVF Become a Right?

In February 2025, President Trump signed an executive order pushing for better IVF access, directing agencies to explore ways to lower costs and expand coverage. It’s not law yet—Congress would need to act—but it’s sparked buzz. Trump’s campaign promise? Make insurers or the government cover IVF. Critics, like the Cato Institute, estimate that’d cost $7 billion a year, and legal challenges could stall it (think birth control mandate fights). Still, it’s a sign IVF’s getting political attention.

State-Level Wins

California’s new law (SB 729) is a big deal—9 million people will gain IVF coverage starting mid-2025. Nebraska’s eyeing a bill (LB233) to cover IVF for state employees, too. These moves show states are stepping up where the feds haven’t.

Employer Trends

Big companies are jumping on the fertility bandwagon. Google, Apple, and others now offer IVF benefits to attract talent. A 2024 Mercer survey found 70% of employers with 5,000+ workers cover IVF—way up from a decade ago. Smaller firms are slower to follow, but the trend’s clear: fertility perks are a competitive edge.

Three Under-the-Radar Factors Affecting IVF Coverage

Most articles skim the surface—state laws, plan types, costs. But there are deeper layers that don’t get enough airtime. Here’s what you need to know.

1. The “Infertility Definition” Trap

Insurance often requires an infertility diagnosis before covering IVF. Sounds fair, right? Not always. The standard definition—trying to conceive for 12 months without success (or 6 months if you’re over 35)—excludes some groups:

- LGBTQ+ couples: They don’t “try” the traditional way, so insurers might deny them.

- Single individuals: Same deal—no partner, no “infertility” by some plans’ rules.

A 2023 ASRM report called this out, pushing for broader definitions. Some states, like New York, now include same-sex couples and singles in mandates, but it’s not universal. Check your policy’s fine print—it could save you a fight.

2. Hidden Costs of “Covered” IVF

Even with insurance, sneaky expenses pop up. A 2022 study in Fertility and Sterility found that patients with coverage still paid an average of $3,500 per cycle for extras like:

- Storage fees: Freezing embryos can cost $500-$1,000 a year.

- Specialist consults: Out-of-network doctors add up.

- Failed cycles: If your plan caps at three tries, you’re on your own after that.

Tip: Ask your clinic for a full cost breakdown before you start. It’s better to know upfront than get blindsided later.

3. The Mental Health Connection

IVF is stressful—financially and emotionally. Yet few talk about how insurance (or lack of it) ties into mental health. A 2024 Stanford study found that couples without IVF coverage were 40% more likely to report anxiety or depression during treatment. Why? The pressure of funding it themselves. On X, people are trending this frustration, with posts like “Insurance won’t cover IVF, but my therapy bills are through the roof.” It’s a cycle—stress impacts success rates, which ups the need for more cycles. Some employers are catching on, bundling counseling with fertility benefits. Ask if yours does.

How to Figure Out If Your Insurance Covers IVF

Feeling overwhelmed? Don’t worry—here’s a step-by-step guide to get answers.

Step 1: Check Your State’s Laws

Google “infertility insurance mandate [your state]” or visit Resolve.org for a state-by-state list. If you’re in a mandate state, you’ve got leverage.

Step 2: Read Your Policy

Grab your insurance handbook (online or paper) and search for “infertility,” “IVF,” or “assisted reproductive technology.” Look for:

- What’s covered (cycles, meds, etc.).

- Limits (age, number of tries).

- Exclusions (e.g., no PGT).

Step 3: Call Your Insurer

Don’t skip this. Dial the number on your insurance card and ask:

- “Does my plan cover IVF?”

- “What’s the out-of-pocket max?”

- “Are there in-network fertility clinics?”

Pro tip: Record the call or get a reference number—customer service reps can give conflicting info.

Step 4: Talk to HR

If you’re insured through work, ask HR if your plan includes fertility benefits. Self-funded? They’ll know. Some companies offer extras through third parties like Progyny—worth checking.

Step 5: Get Clinic Input

Your fertility clinic deals with insurance daily. They can verify coverage and spot gaps. Many offer free consults—use them.

What to Do If Insurance Won’t Pay

No coverage? You’ve still got options. Here’s how to make IVF work without breaking the bank.

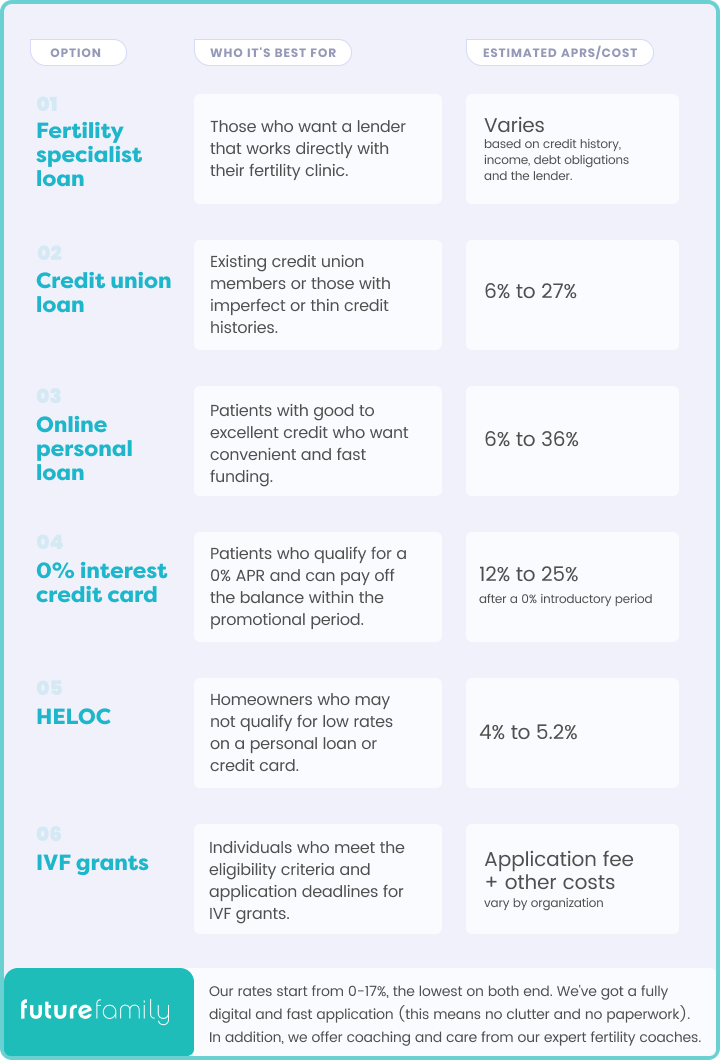

Financing and Loans

- Fertility-specific loans: Companies like Advanced Reproductive Care offer low-interest options tailored for IVF.

- 0% credit cards: Some cards give you 12-18 months interest-free—perfect for spreading costs.

- Home equity loans: Riskier, but lower rates than personal loans.

Grants and Discounts

- Resolve: Lists scholarships like the Baby Quest Foundation (up to $15,000).

- Clinic programs: Some offer refunds for unused cycles or discounts for multiple tries.

- Clinical trials: Check ClinicalTrials.gov for free or low-cost IVF studies near you.

Crowdfunding

Sites like GoFundMe are popular for IVF. Jen from Georgia raised $5,000 this way. Share your story—people love helping dreams come true.

Out-of-Pocket Hacks

- Shop around: Clinic prices vary—$12,000 in one city might be $15,000 in another.

- Medication savings: Apps like GoodRx can cut drug costs by 20-30%.

- Travel abroad: Places like Mexico or Spain offer IVF for $5,000-$8,000, though travel adds up.

Poll: What’s Your Biggest IVF Worry?

We want to hear from you! Pick one:

- A) Cost—no idea how I’ll pay for it.

- B) Insurance—will it cover enough?

- C) Success—what if it doesn’t work?

- D) Stress—it’s all too much.

Drop your answer in the comments or imagine circling it on your screen. It’s a quick way to connect with others in the same boat.

The Future of IVF Coverage: What’s Next?

IVF coverage is evolving, and the next few years could shake things up. That executive order from 2025? It’s a wild card—could lead to federal mandates or fizzle out. States like California are setting a precedent, and if more follow, pressure might build for a national standard. Employers are another driver—fertility benefits are becoming a must-have perk, especially for younger workers.

On the flip side, pushback is real. Some argue IVF shouldn’t be “essential” healthcare, citing costs or ethics (like embryo debates in Alabama). A 2024 Cato estimate pegged universal IVF coverage at $7 billion annually—taxpayers might balk. Still, with fertility rates dropping (58.2 births per 1,000 women in 2019, per CDC), governments might see IVF as a fix.

My Take: A Simple Fix No One’s Talking About

Here’s a thought: why not tax credits for IVF? Instead of mandating insurance, give families a $5,000-$10,000 credit per cycle. It’s direct, flexible, and sidesteps the self-funded plan loophole. Canada does something similar with fertility expenses—why not here? It’d ease the burden without overhauling insurance. Food for thought.

Wrapping Up: Your IVF Journey Starts Here

So, does insurance pay for IVF? Sometimes—depends on your state, plan, and luck. It’s a messy system, but you’re not powerless. Check your coverage, explore options, and don’t be afraid to push back. IVF’s a big deal, emotionally and financially, but people make it work every day. Sarah did. Mike and Jen did. You can too.

Got questions? Hit up your insurer, talk to a clinic, or drop a comment below. Your next step might be closer than you think.